41 how to determine coupon rate

14.1: Determining the Value of a Bond - Mathematics LibreTexts Bond Coupon Rate. Also known as the bond rate or nominal rate, the bond coupon rate is the nominal interest rate paid on the face value of the bond. The coupon rate is fixed for the life of the bond. Most commonly the interest is calculated semi-annually and payable at the end of every six-month period over the entire life of the bond, starting from the issue date. › discount-rate-formulaDiscount Rate Formula | How to calculate Discount Rate with ... The formula for the discount rate can be derived by using the following steps: Step 1: Firstly, determine the value of the future cash flow under consideration. Step 2: Next, determine the present value of future cash flows. Step 3: Next, determine the number of years between the time of the future cash flow and the present day. It is denoted by n.

Understanding Bond Prices and Yields - Investopedia We must convert those values into a percentage to determine the dollar amount we will pay for the bond. To do so, we first divide 29 by 32. This equals .90625. We then add that amount to 99 (the...

How to determine coupon rate

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,... Coupon Rate - Meaning, Example, Types | Yield to Maturity ... The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of ... How to calculate yield to maturity in Excel (Free Excel ... RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%.

How to determine coupon rate. Treasury Inflation-Protected Securities (TIPS) Explained Treasury inflation-protected securities (TIPS) are a form of U.S. Treasury bond designed to help investors protect against inflation. They are indexed to inflation, have U.S. government backing, and pay investors a fixed interest rate as their par value adjusts with the inflation rate. 1. How to Perform Bond Valuation with Python | by Bee Guan ... The YTM of the bond is about 7.89%. Since the bond coupon rate (5%) is less than its YTM, the bond is selling at a discount. On another hand, if the coupon rate is more than its YTM, the bond is selling at a premium. YTM is useful for an investor to determine if a bond is purchased with a good deal. Bond Pricing | Valuation | Formula | How to calculate with ... Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. The following is the summary of bond pricing: What Is a Treasury Note? How Treasury Notes Work for Beginners A Treasury note is a type of U.S. government debt security with a set interest rate and a maturity period ranging from one to ten years. Interest rates are determined at the federal level, just like a Treasury bond or a Treasury bill. Treasury notes are highly common investments because they are available on the secondary market.

Inverse Floaters | Coupon Formula, Calculation & Example ... › terms › aAnnualize Definition Mar 09, 2021 · Unannualized: A rate of return on an investment for a period other than one year. An unannualized return may be used to report results for a month, quarter or for several years. When the returns ... Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Posted by Dinesh on 27-06-2021T07:56 This calculator calculates the coupon rate using face value, coupon payment values. Zero Coupon Bond: Definition, Formula & Example - Video ... Use the following table to answer the questions below: Bond Par Value Years to Maturity Yield to Maturity Coupon Rate A $1000 12% 0% B $1000 24% 0% C$1000 37% 0% D $1000 49% 0% A. A. Calculate the sho

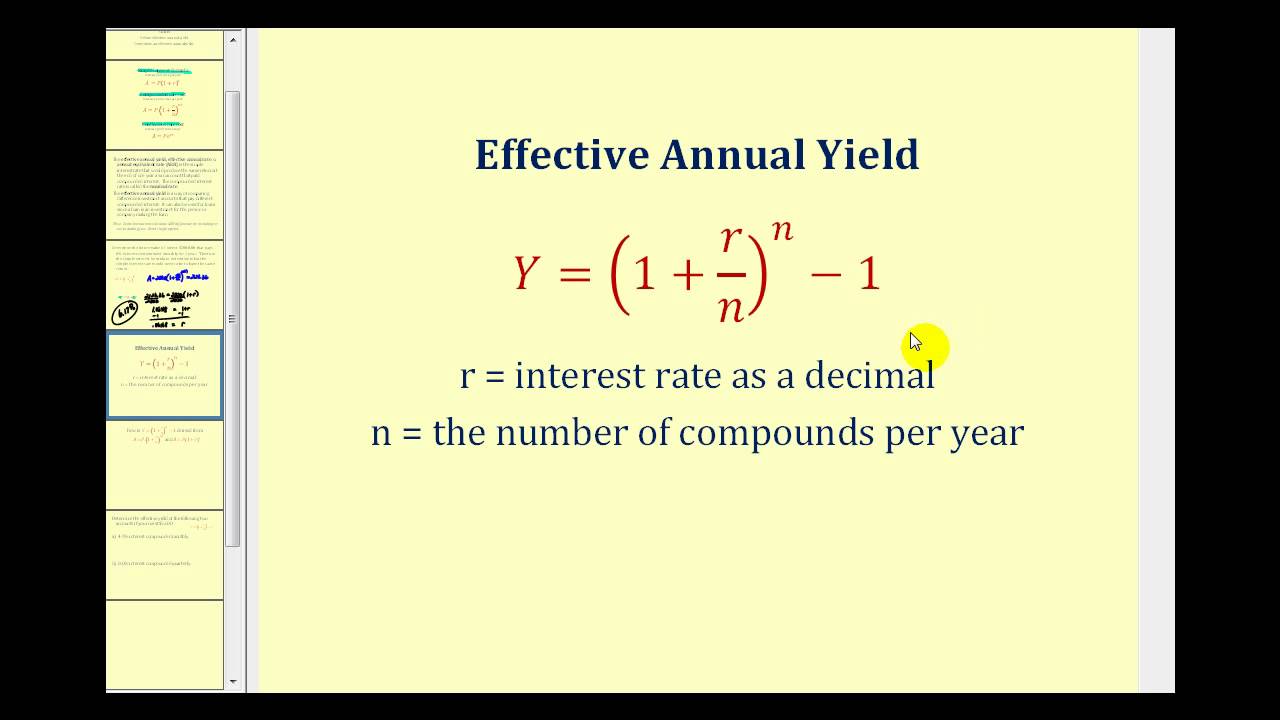

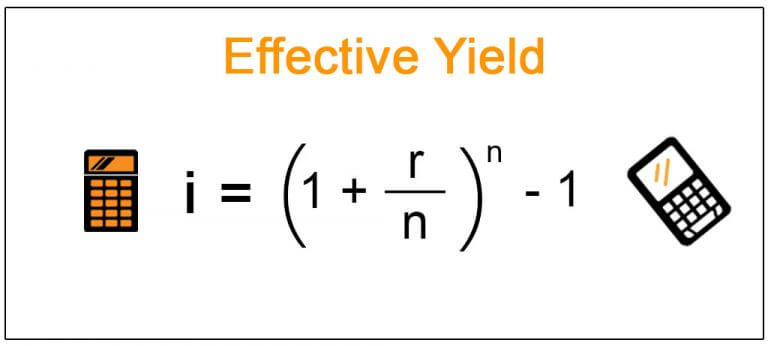

Bond Discount Since interest payments are made on a semi-annual basis, the total number of coupon payments is 3 years x 2 = 6, and the interest rate per period is 5%/2 = 2.5%. Using this information, the present... Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Yield to Maturity Calculator | Calculate YTM coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. How to Calculate Cost of Debt (& Why Knowing Yours Matters) After-Tax Cost of Debt = Average Interest Expense x (1 - Tax Rate) The average interest rate is calculated by taking all of the interest paid for the year and dividing it by the total debt. To illustrate how the formula works, let's assume your average interest rate for the year was 6% and tax rate is 35%.

What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Calculating the Intrinsic Value of a Bond - BrainMass a. Determine the current value of the bond if present market conditions justify a 14 percent required rate of return. Required rate of return=rate=14% Number of periods=nper=4 Coupon amount=pmt=1000*7%=$70 Par Value of bond=fv=$1,000 Type of paument=type=0 0 indicate end of period payments

How to Calculate the Fair Value of a Bond | Sapling Add one to the coupon rate and then raise it to the power of the yearly payout rate as expressed in numerals (so 10 percent becomes 0.1 ). Divide one by the result and then subtract that from one. The result is the overall discount rate. Next, take the overall discount rate and divide it by the current yearly rate.

Bond Basics: Issue Size and Date, Maturity Value, Coupon Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Bootstrapping Spot Rates - CFA, FRM, and Actuarial Exams ... Bootstrapping spot rates is a forward substitution method that allows investors to determine zero-coupon rates using the par yield curve. The par curve shows the yields to maturity on government bonds with coupon payments, priced at par, over a range of maturities.. Bootstrapping involves obtaining spot rates (zero-coupon rates) for one year, then using the one-year spot rate to determine the ...

How to Calculate the Yield of a Zero Coupon Bond Using ... So let's go ahead and start plugging in so we see here we have (1 + the forward rate) from year 1 so that's 7% so that's same as 0.07 so we'd have ( 1 + 0.07) is going to be that first term. So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%.

Arbitrage Free Value - CFA, FRM, and Actuarial Exams Study ... Arbitrage-Free Valuation of an Option-Free, Fixed-Rate Coupon Bond. An arbitrage-free value is the present value of expected future values using Treasury spot rates for option-free bonds. Arbitrage-free valuation usually involves three main steps: Step 1: Estimate the future cash flows. Step 2: Determine the appropriate discount rates that should

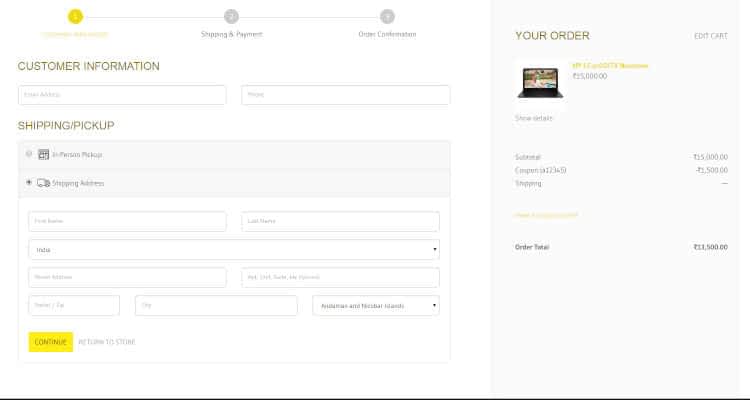

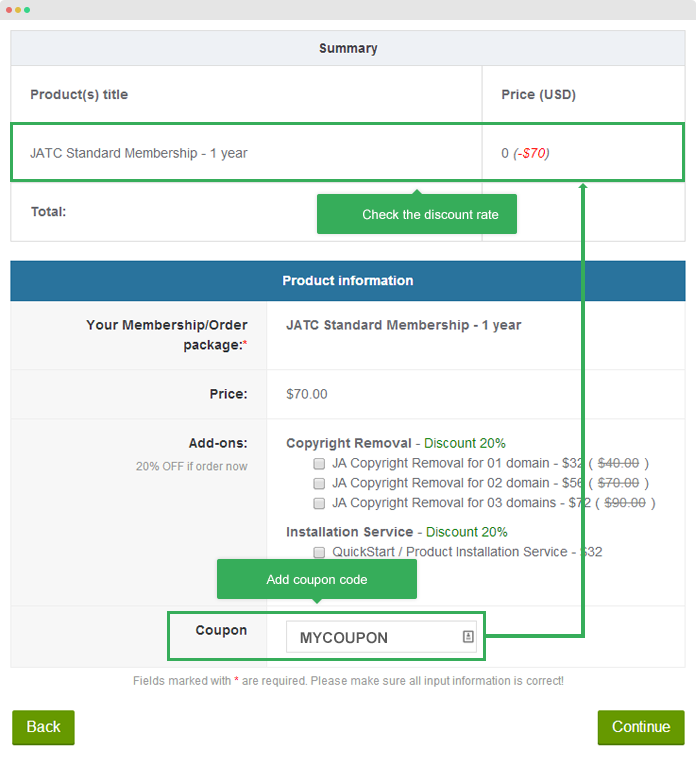

Finding out the price, comparing prices, and getting a lower price - Simple and Practical Mental ...

Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon Rate: Definition, Formula & Calculation - Video ... The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is the...

Coupon Payment Calculator If you want to calculate the annual coupon payment for a bond, all you have to do is multiply the bond's face value by its annual coupon rate. That means if you have a bond with a face value of $1000 and an annual coupon rate of 10%, then the annual coupon payment is 10% of $1000, which is $100.

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

How to calculate yield to maturity in Excel (Free Excel ... RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity ... The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of ...

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

Post a Comment for "41 how to determine coupon rate"