43 bond yield vs coupon rate

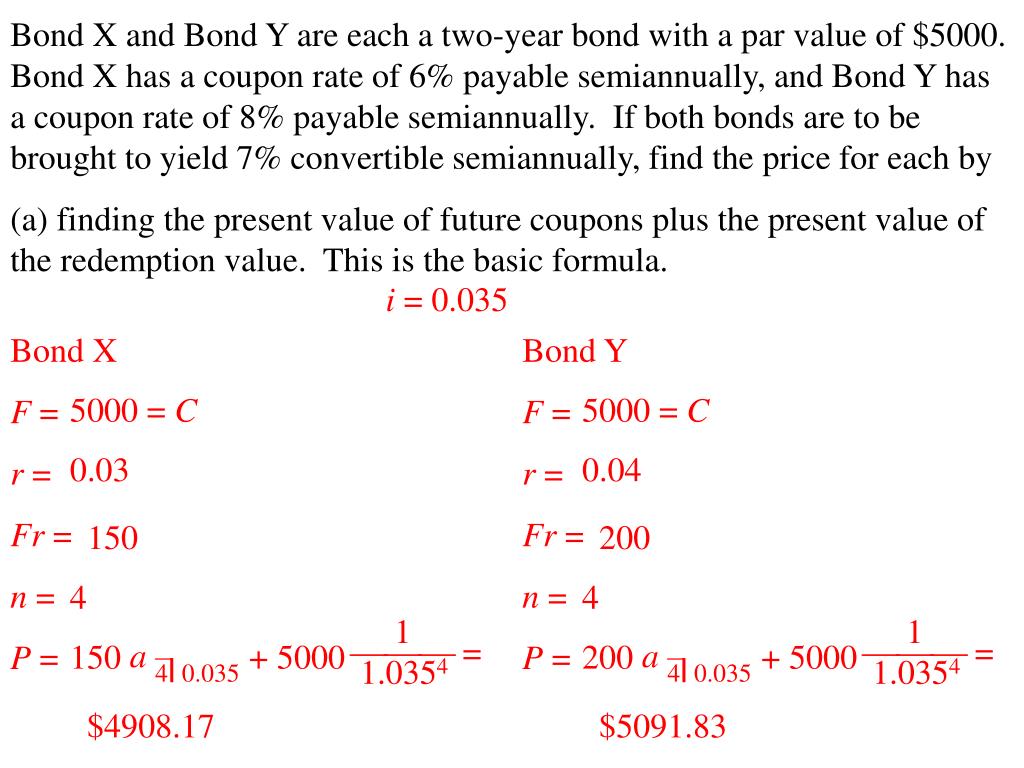

Bond Yield Calculator - Compute the Current Yield On this page is a bond yield calculator to calculate the current yield of a bond. Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula. Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon amount is the amount that is paid out semi-annually or annually till the maturity date on the face value of the bond. While current yield generates the return annually depend on the market price fluctuation. Coupon rates are more likely influenced by the interest rates fixed by the government body on the basis country's economy.

Bond Yield Rate vs. Coupon Rate: What's the Difference? Bond Yield Rate vs. Coupon Rate: An Overview A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as...

Bond yield vs coupon rate

Best Bond Funds for April 2022: Based on Yield, Fees & More 03/08/2021 · It has an AUM of $8,877 million and a 1-year return rate of 94.15%, a 3-year return rate of 222.58% and a 5-year return rate of 622.54%. This ETF has a 52-week low of $32.27 and a 52-week high of ... China Government Bonds - Yields Curve 23/04/2022 · Last Update: 24 Apr 2022 14:15 GMT+0. The China 10Y Government Bond has a 2.854% yield.. 10 Years vs 2 Years bond spread is 56.1 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.70% (last modification in January 2022).. The China credit rating is A+, according to Standard & Poor's agency.. Current 5-Years Credit … Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond yield vs coupon rate. Understanding Bond Prices and Yields - Investopedia The same holds true for bonds priced at a discount; they are priced at a discount because the coupon rate on the bond is below current market rates. Yield Tells (Almost) All A yield relates a... Bond Coupon Interest Rate: How It Affects Price At $715, the bond's yield is competitive. Conversely, a bond with a coupon rate that's higher than the market rate of interest tends to rise in price. If the general interest rate is 3% but the... Bond Prices, Rates, and Yields - Fidelity Yield to maturity requires a complex calculation. It considers the following factors. Coupon rate—The higher a bond's coupon rate, or interest payment, the higher its yield. That's because each year the bond will pay a higher percentage of its face value as interest. Price—The higher a bond's price, the lower its yield. Fixed Income 101: Coupon Rate vs Yield for a Bond: Easy ... This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ...

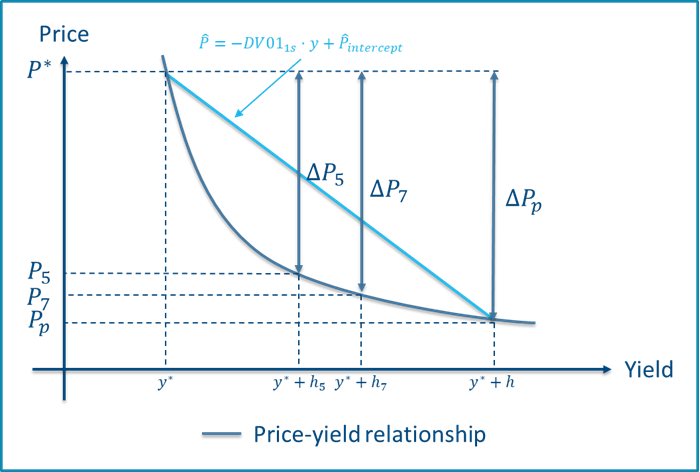

money.usnews.com › investing › bondsHow Bond Maturity Works | Bonds | US News Mar 12, 2020 · The term interest-rate sensitivity reflects what happens to the dollar price of a bond if interest rates rise or fall. A bond's yield and its price move inversely to reflect current interest rates. Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … Difference Between Bond Yield and Coupon Rate (With Table) Bond Yield stands for the rate of return on a bond, whereas the coupon rate shows the interest that is to be received by the bondholder annually. The Bond Yield ...Formula: The Bon Yield is calculated by the for...Mutual Relation: If a bond is purchased at a re... dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Bond Yield Rate Vs. Coupon Rate: What's The Difference? () Bond Yield Rate vs. Coupon Rate: An Overview A bond's coupon fee is the velocity of curiosity it pays yearly, whereas its yield is the velocity of return it generates. A bond's coupon worth is expressed as a proportion of its par price. The par price is solely the face price of the bond… Bond Yield Formula | Step by Step Calculation & Examples Bond Yield =4.875%; Here we have to saw that increase in bond prices results in the decrease in bond yield. Example #2. If a bond has a face value of $1000 and its prices $970 now and the coupon rate is 5%, find the bond yield. Face Value =$1000; Coupon Rate=5%; Bond Price = $970; Solution: Coupon Rate vs Yield Rate for Bonds - Wall Street Oasis If by Yield you mean Yield to Maturity, then it is the discount rate on the bond's cash flows. Bond Price = NPV of the CF's of the Bond = (Face Value)(Coupon Rate)/(1 + YTM) + (Face Value)(Coupon Rate)/(1 + YTM)^2 + ... + [(Face Value)*(Coupon Rate) + Face Value]/(1 + YTM)^n, where n is maturity for the bond. Since interest rates (discount rates) for each period aren't necessarily the same, if ... Yield Vs. Interest Rate: Understanding the Differences ... When you hold bonds, the yield is expressed as yield-to-maturity. This is the total amount you can expect to get from the bond once the bond matures. In this case, the yield will depend on the interest rate you agreed on with the issuer when you bought the bonds. Yield Vs. Interest Rates: The Implications

[Solved] What is the discount yield, bond equivalent yield, and effective annual return on a $1 ...

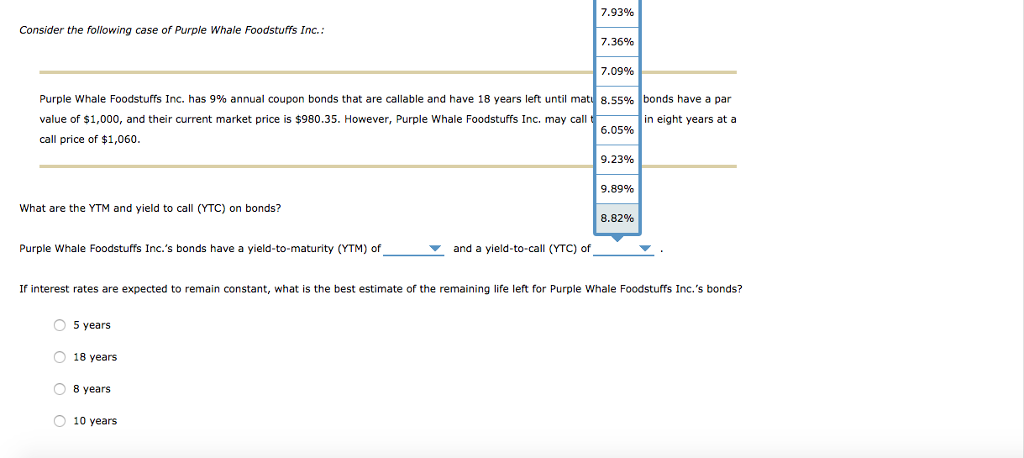

Par, Premium, Discount Bonds - Studio Cangemi The coupon rate remains fixed over the lifetime of the bond, while the yield-to-maturity is bound to change. The bonds themselves pay tax-free interest into a pool, which investors are eligible for through the purchase of said bonds. Interest rates regularly fluctuate, making each reinvestment at the same rate virtually impossible.

Bond yield vs coupon rate: Why is RBI trying to keep yield ... For example, if the coupon rate of a 10-year bond of face value of Rs 1,000 is 6 per cent, it will pay interest of Rs 60 every year on each bond for the investment period of 10 years. On the other...

What Is the Coupon Rate of a Bond? Coupon Rate vs. Yield . In contrast to the bond's coupon rate, which is a stated interest rate based on the bond's par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond.

Difference Between Yield to Maturity and Coupon Rate ... Summary - Yield to Maturity vs Coupon Rate. Bonds are an attractive investment to equity and are invested in by many investors. While related, the difference between yield to maturity and coupon rate does not depend on each other completely; the current value of the bond, difference between price and face value and time until maturity also affects in varying degrees.

PPT - Example 6.1 illustrates the calculation of a yield rate for a zero coupon bond. PowerPoint ...

Yield to Maturity vs. Coupon Rate: What's the Difference? Aug 22, 2021 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

› terms › bBond Definition Feb 23, 2022 · Discovery Bond: A type of fidelity bond used to protect a business from losses caused by employees committing acts of fraud. A discovery bond covers losses that are discovered while the bond is in ...

Bond Yield Rate Vs Coupon Rate - TiEcon 2018 When the market rate of return exceeds the coupon rate, a bond will sell at A) par. A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it normal balance generates. A bond's coupon rate is expressed as a percentage of its par value.

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

Post a Comment for "43 bond yield vs coupon rate"