38 difference between yield to maturity and coupon rate

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Black–Scholes model - Wikipedia Denoting by S the FOR/DOM exchange rate (i.e., 1 unit of foreign currency is worth S units of domestic currency) one can observe that paying out 1 unit of the domestic currency if the spot at maturity is above or below the strike is exactly like a cash-or nothing call and put respectively. Similarly, paying out 1 unit of the foreign currency if ...

Convertible Bond: Definition, Example, and Benefits Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

Difference between yield to maturity and coupon rate

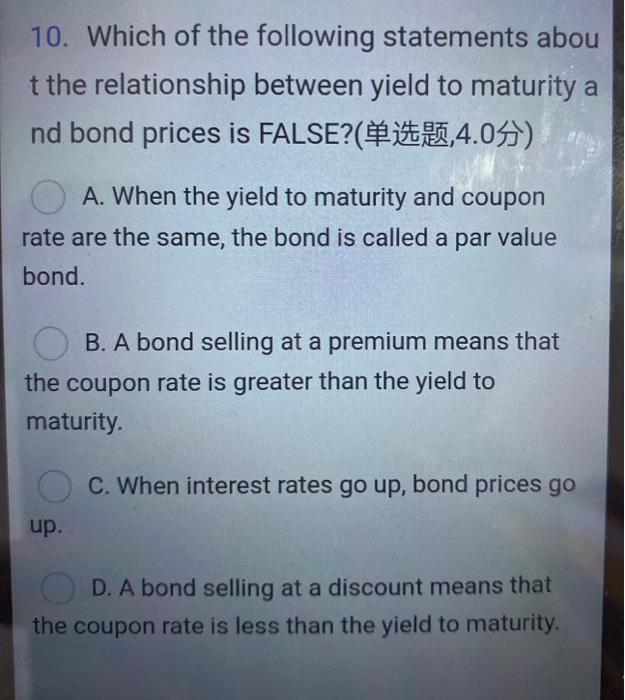

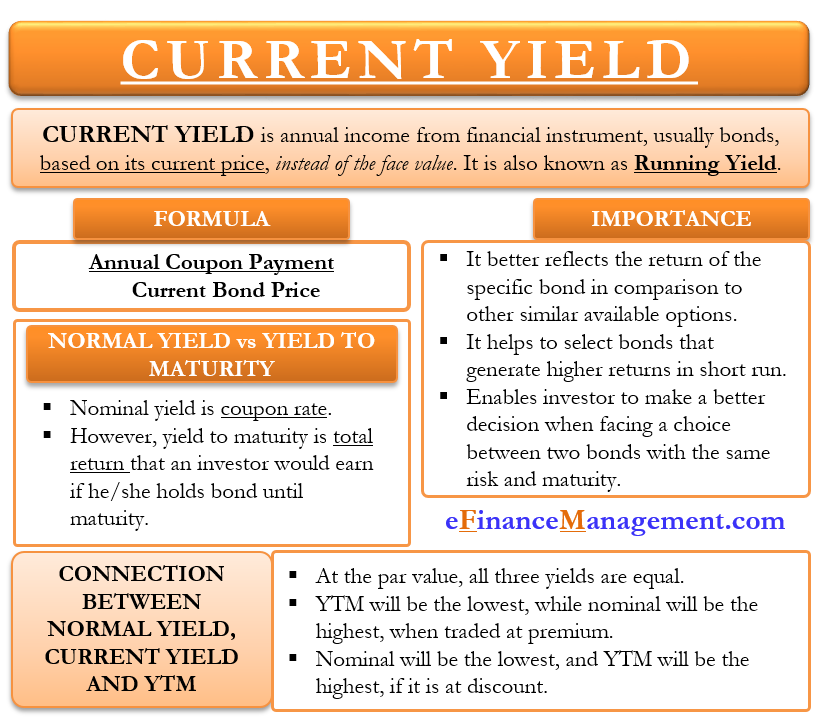

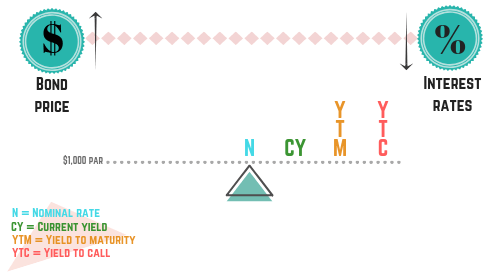

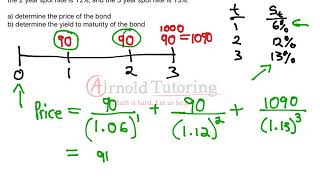

The Difference Between Coupon and Yield to Maturity - The Balance Mar 04, 2021 · Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. Forward Rate vs. Spot Rate: What's the Difference? - Investopedia Jun 30, 2022 · The difference between the spot rate and forward rate is known as the basis. ... If an investor buys a bond that is nearer to maturity, the forward rate on the bond will be higher than the ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Difference between yield to maturity and coupon rate. U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Forward Rate vs. Spot Rate: What's the Difference? - Investopedia Jun 30, 2022 · The difference between the spot rate and forward rate is known as the basis. ... If an investor buys a bond that is nearer to maturity, the forward rate on the bond will be higher than the ... The Difference Between Coupon and Yield to Maturity - The Balance Mar 04, 2021 · Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/female-executive-talking-to-colleagues-117455512-5750d4d75f9b5892e8b3d3af.jpg)

Post a Comment for "38 difference between yield to maturity and coupon rate"