40 what is coupon for bond

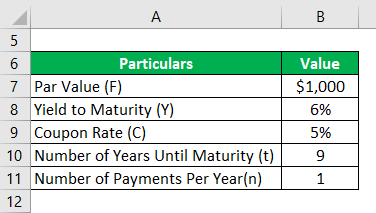

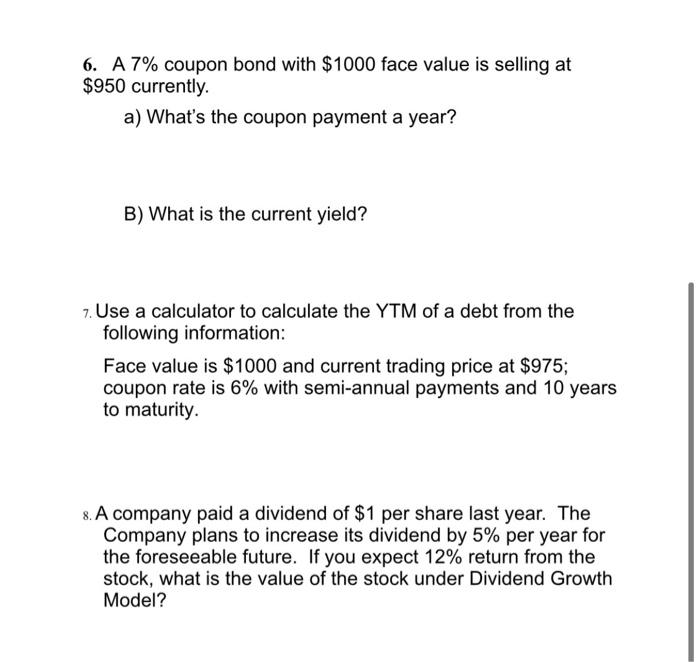

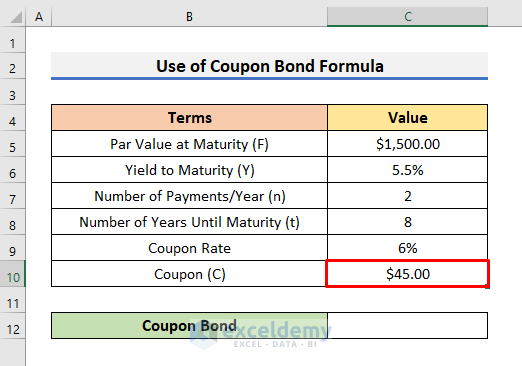

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. How to Calculate the Price of Coupon Bond? - WallStreetMojo The term “ coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more ” refers to bonds that pay coupons which is a nominal percentage of the par value or principal amount …

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

What is coupon for bond

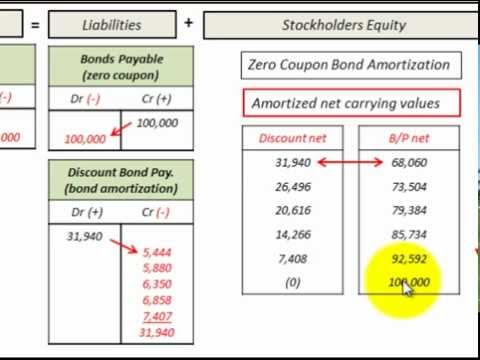

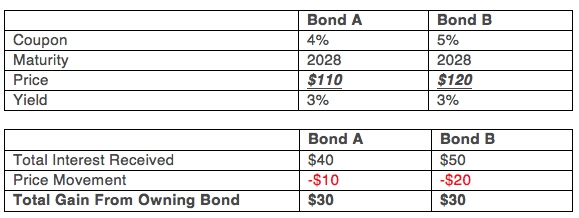

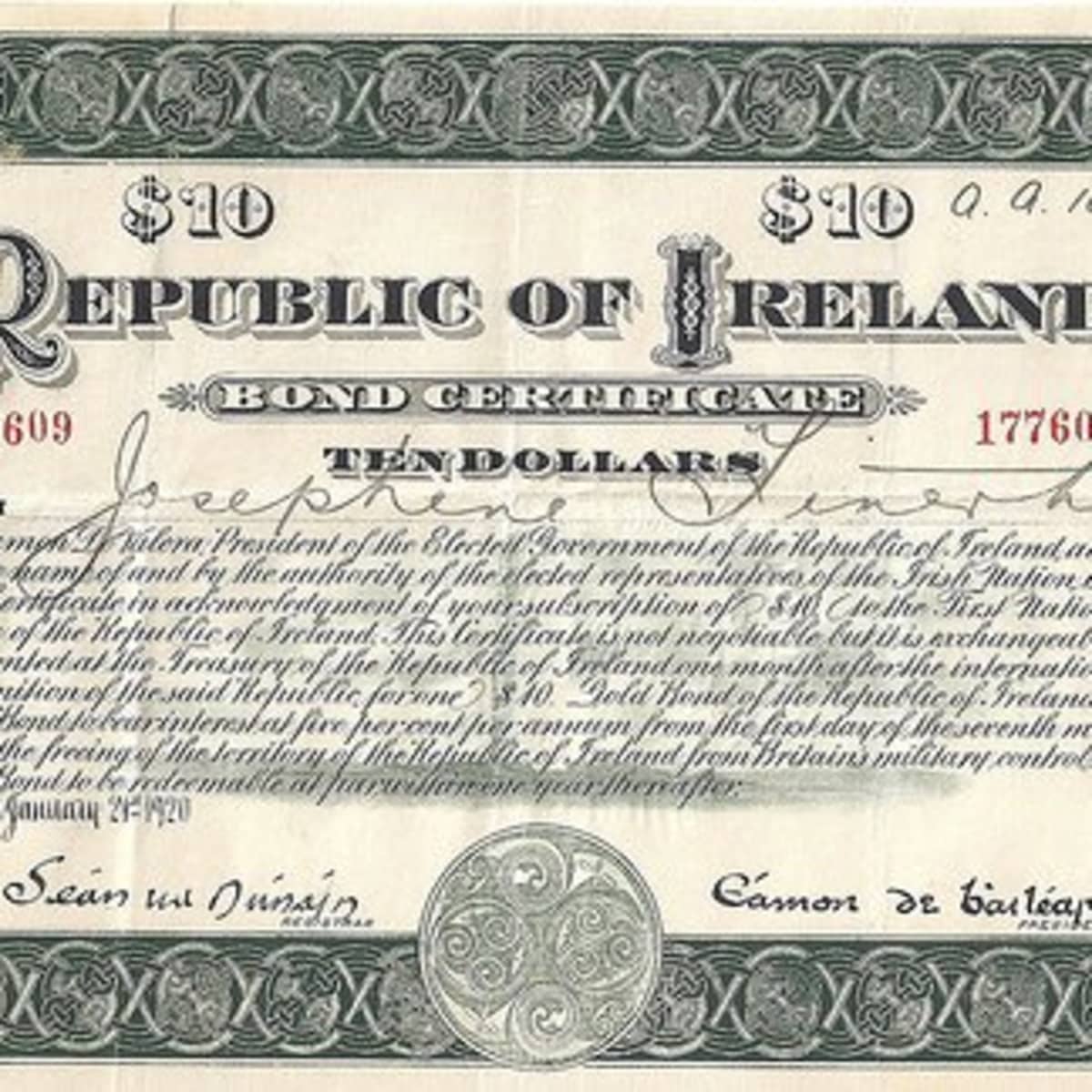

Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ... What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to … Coupon Bond: Definition, How They Work, Example, and Use Today Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

What is coupon for bond. Treasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America’s Finances. Monthly Treasury Statement. Daily Treasury Statement. How Your Money Is Spent. USAspending.gov. National Debt. National Debt to the Penny. Historical Debt Outstanding. Monthly Statement of the Public Debt Quarterly Refunding. Debt Management … What Is a Bond Coupon, and How Is It Calculated? - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. James Bond - Wikipedia Fleming endowed Bond with many of his own traits, including sharing the same golf handicap, the taste for scrambled eggs, and using the same brand of toiletries. Bond's tastes are also often taken from Fleming's own as was his behaviour, with Bond's love of golf and gambling mirroring Fleming's own. Fleming used his experiences of his career in ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, …

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Coupon Bond: Definition, How They Work, Example, and Use Today Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to …

Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

![Solved Problem 6-26 Zero Coupon Bonds [LO 2] Suppose your ...](https://media.cheggcdn.com/study/333/33375a27-db78-487d-9837-fdf48c6f2a19/image.png)

Post a Comment for "40 what is coupon for bond"