44 how to determine coupon rate

NHS Test and Trace: what to do if you are contacted - GOV.UK May 27, 2020 · NHS Test and Trace helps to control the rate of reproduction (R), reduce the spread of the infection and save lives. What has changed The self-isolation advice for people with coronavirus (COVID ... › 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft is quietly building an Xbox mobile platform and store. The $68.7 billion Activision Blizzard acquisition is key to Microsoft’s mobile gaming plans.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

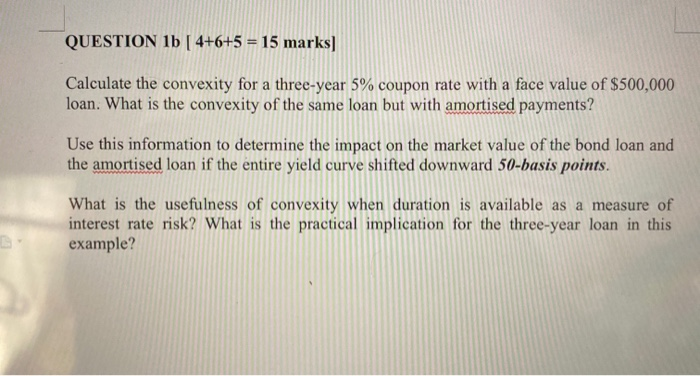

How to determine coupon rate

Internal Rate of Return (IRR) Rule: Definition and Example - Investopedia Aug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is ...

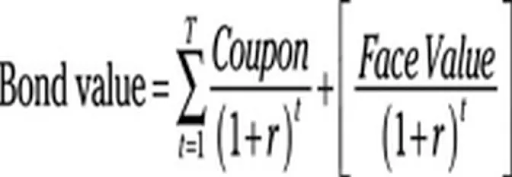

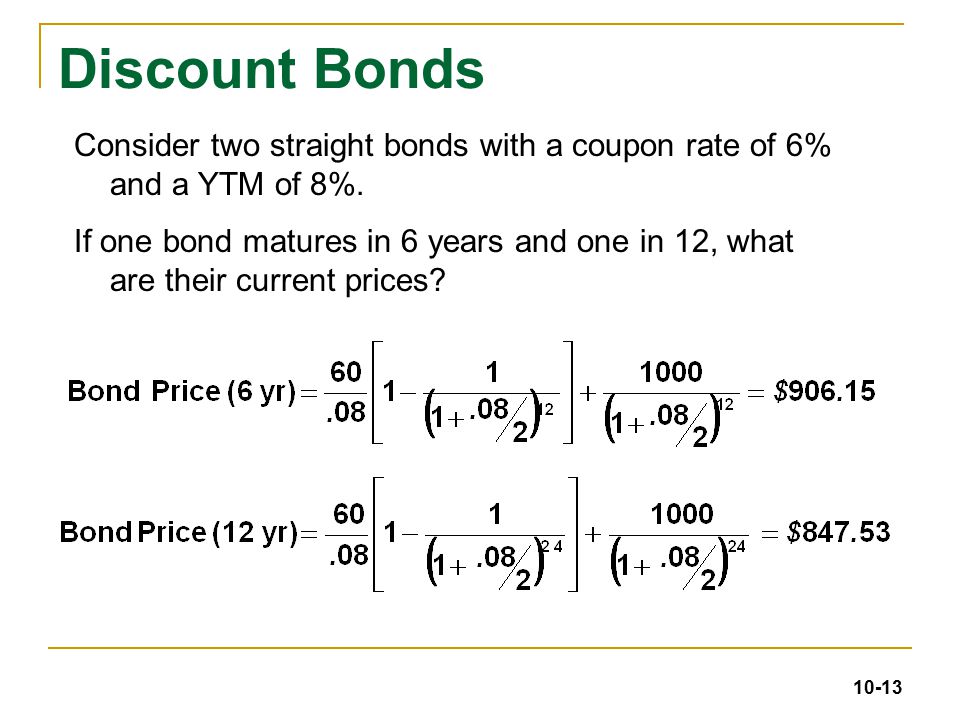

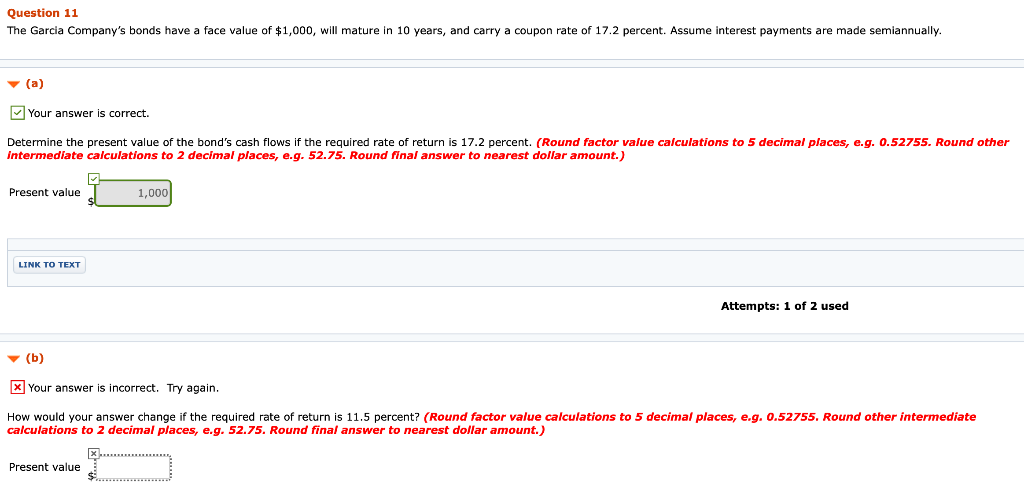

How to determine coupon rate. Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. However, some bonds have par values that are... Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100. Black–Scholes model - Wikipedia The Black–Scholes / ˌ b l æ k ˈ ʃ oʊ l z / or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of ... What Is a Coupon Rate? How To Calculate Them & What They're Used For How Do You Calculate the Coupon Rate? Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. How to Calculate Coupon Rate in Excel (3 Ideal Examples) 2. Calculate Coupon Rate with Monthly Interest in Excel. In the following example, we will calculate the coupon rate with monthly interest in Excel. This is pretty much the same as the previous example but with a basic change. Monthly interest means you need to pay the interest amount each month in a year. So, the number of payments becomes 12 ... Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of... Publication 15-B (2022), Employer's Tax Guide to Fringe Benefits The rules used to determine the value of a fringe benefit are discussed in section 3. If the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be reported on Form W-2, Wage and Tax Statement. ... Items included in cents-per-mile rate. The cents-per-mile rate includes the value ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1% Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% › guidance › nhs-test-and-trace-how-it-worksNHS Test and Trace: what to do if you are contacted - GOV.UK May 27, 2020 · NHS Test and Trace helps to control the rate of reproduction (R), reduce the spread of the infection and save lives. What has changed The self-isolation advice for people with coronavirus (COVID ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

› newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

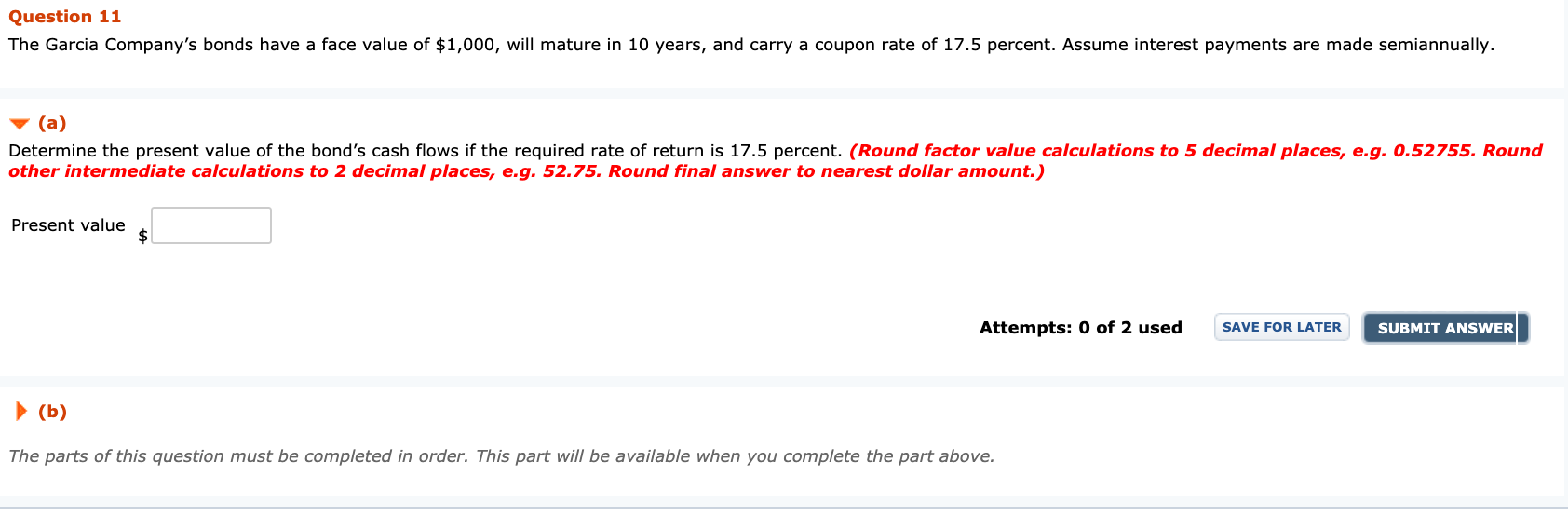

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

en.wikipedia.org › wiki › Black–Scholes_modelBlack–Scholes model - Wikipedia Interest - rate curve. In practice, interest rates are not constant—they vary by tenor (coupon frequency), giving an interest rate curve which may be interpolated to pick an appropriate rate to use in the Black–Scholes formula. Another consideration is that interest rates vary over time.

› terms › iInternal Rate of Return (IRR) Rule: Definition and Example Aug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ...

Market Value - Overview, How To Express, How To Calculate Market Value per Share: It is calculated by considering the market value of a company divided by the total number of outstanding shares. Market/Book Ratio: The market/book ratio is used to compare a company's market value to its book value. It is calculated by dividing the market value per share by the book value per share.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How To Determine Coupon Rate - bizimkonak.com Coupon Rate Formula Step by Step Calculation (with … CODES (1 days ago) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your …

Microsoft is building an Xbox mobile gaming store to take on … Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

Internal Rate of Return (IRR) Rule: Definition and Example - Investopedia Aug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ...

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 how to determine coupon rate"